Retirement Accounts & Divorce: How QDROs Really Work Step-by-Step Guide

Originally published: October 2025 | Reviewed by Carol Ann Mazza

Dividing retirement accounts during divorce is complex. A Qualified Domestic Relations Order (QDRO) ensures assets like 401(k)s and pensions are split legally and fairly.

A lot of people think listing retirement accounts in their divorce decree does the trick, but it doesn’t actually split the money.

A QDRO is a court order that tells retirement plan administrators exactly how to split employer-sponsored accounts like 401(k)s and pensions between divorcing spouses.

If you don’t have this document, the non-employee spouse won’t get their share of the retirement funds—even if the divorce decree says they should.

QDROs are essential for ensuring retirement benefits are divided according to the marital settlement agreement. The process involves steps and deadlines, and missing them can cause significant problems.

Key Takeaways

- A QDRO is required to divide employer-sponsored retirement accounts like 401(k)s and pensions in divorce.

- The QDRO process involves multiple steps including court approval and plan administrator review.

- Common mistakes with QDROs can be avoided through proper planning and understanding tax implications.

What Is a QDRO in Divorce?

A Qualified Domestic Relations Order (QDRO) lets certain retirement accounts get split during divorce without tax penalties.

Retirement assets play by different rules than other marital property because federal law shields them from creditors and third parties.

Why Retirement Assets Require Special Division Rules

Retirement accounts like 401(k)s and pensions fall under federal ERISA law. This law prevents anyone except the account owner from accessing the funds.

ERISA protections mean that even a spouse cannot obtain retirement funds through a regular divorce decree. Plan administrators will say no to any distribution without the correct QDRO paperwork.

Tax consequences also come into play. Without a QDRO, retirement distributions during divorce can trigger:

- 10% early withdrawal penalty

- Full income tax on the amount

- Immediate tax liability for the account owner

A properly executed QDRO prevents these penalties and allows tax-free transfers between spouses. The receiving spouse pays taxes only when they eventually take the money out.

Difference Between QDROs and Regular Divorce Decrees

A divorce decree divides marital property but can’t directly access retirement accounts. Plan administrators require specific QDRO language that meets federal requirements.

Key differences include:

| Divorce Decree | QDRO |

| General property division | Specific retirement account instructions |

| Court approval only | Court approval + plan administrator approval |

| Immediate effect | Effective after plan review |

The QDRO must specify the name of the retirement plan, the participant, and the alternate payee. It outlines the amount to be transferred and when payments will commence.

Each retirement plan has unique requirements for QDRO language. A decree that works for one 401(k) might not work for another company’s plan. The plan’s rules, rule.

CollaborativeNow helps Florida couples divide retirement assets fairly during divorce. Protect your long-term savings—schedule your confidential consultation with us today.

If you’re ready to get started, call us now!

Which Retirement Accounts Require a QDRO?

Not every retirement account needs a QDRO for divorce division. Employer-sponsored plans like 401(k)s and pensions require QDROs. IRAs, on the other hand, follow different rules and can be split with just the divorce decree.

401(k), 403(b), and Pension Plans

These employer-sponsored retirement accounts are protected under ERISA. Without a valid QDRO, retirement plans covered by ERISA can only pay benefits under the terms of the written plan document.

Plans that require a QDRO:

- 401(k) plans

- 403(b) plans

- Traditional pension plans

- Profit-sharing plans

- Money purchase plans

- Employee stock ownership plans (ESOPs)

The plan administrator won’t divide these accounts based solely on a divorce decree. They require the exact language and requirements that only a QDRO can spell out.

Many retirement plans require a QDRO before they will distribute funds to an alternate payee. The QDRO specifies exactly how much each spouse will receive and when payments should begin.

IRAs and Roth IRAs (Special Rules)

IRAs and Roth IRAs don’t require QDROs for divorce division. ERISA rules don’t cover these accounts.

The receiving spouse can transfer IRA funds directly through the divorce decree. The transfer must happen as part of the divorce settlement to avoid taxes and penalties.

Key differences for IRAs:

- No QDRO needed

- The divorce decree authorizes the transfer

- Must be completed as incident of the divorce

- The receiving spouse takes ownership of the transferred portion

The IRA custodian usually takes a certified copy of the divorce decree that clearly states how to divide the account. Some custodians might ask for extra paperwork.

Accounts That Need a QDRO vs. Those That Don’t

| Requires QDRO | No QDRO Needed |

| 401(k) plans | Traditional IRAs |

| 403(b) plans | Roth IRAs |

| Pension plans | SEP-IRAs |

| Profit-sharing plans | SIMPLE IRAs |

| Money purchase plans |

The main difference is ERISA coverage. ERISA-covered plans require QDROs to ensure plan administrators are legally protected when they make payments to individuals other than the participant.

Non-ERISA accounts, such as IRAs, can be split through direct transfer orders specified in the divorce decree. The language in the decree has to be precise, or both spouses could end up with tax issues.

Some plans have their own requirements even within these categories. It’s always a good idea to check with your plan administrator about the process and what paperwork is required. Many plan administrators have a general form that the QDRO will mirror.

Step-By-Step Process of a QDRO

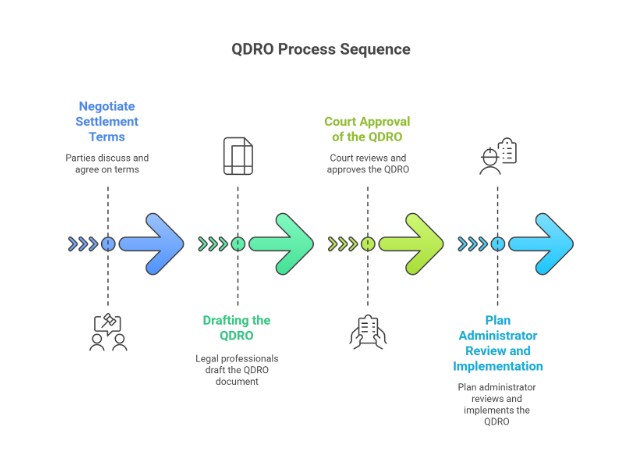

The QDRO process involves three essential steps: negotiating settlement terms, drafting the order, obtaining court approval, and implementing the plan through the plan administrator.

The entire process typically takes between 60 and 120 days, depending on the circumstances.

Step 1 — Negotiate Settlement Terms

First, both spouses have to agree on how to split retirement benefits. This happens during divorce settlement talks or mediation.

They’ll decide the percentage or dollar amount each spouse gets. The couple also needs to pick a valuation date for the account balance.

Common division methods:

- 50/50 split of marital portion

- Specific dollar amount

- Percentage based on years of marriage

- Present value calculation

The divorce decree must specifically state the split of retirement accounts. If the decree isn’t clear, nobody can draft a proper QDRO.

Settlement terms should also address survivor benefits, if applicable. This determines whether the alternate payee keeps benefits if the employee spouse dies.

Step 2 — Drafting the QDRO (With Attorneys or Specialists)

Professional drafting ensures the QDRO meets legal and plan-specific requirements. Collecting all necessary financial information regarding the retirement plan is the first step.

Required information includes:

- Complete retirement plan documents

- Summary plan description

- Plan administrator contact details

- Employee’s full name and Social Security number

- Alternate payee’s complete information

Most plans will preapprove a QDRO to ensure it meets all legal and plan-specific requirements. Getting pre-approval can save a lot of time and headaches down the road.

The QDRO lays out exact benefit amounts and payment timing. It should also mention loan offsets and early distribution penalties, if applicable.

Professional drafters usually charge $500–$1,500 for QDRO prep. Sometimes both parties split this cost, or the divorce decree assigns it.

Step 3 — Court Approval of the QDRO

The finished QDRO goes to the divorce court judge for approval and signature. A thorough pre-court review helps streamline this process and minimizes potential issues.

Courts verify that the QDRO aligns with the terms of the divorce decree. The judge looks for all the required legal elements.

Courts check for:

- Proper party identification

- Clear benefit calculations

- Compliance with federal law

- Consistency with the divorce order

Some courts want both parties to sign the QDRO before the judge signs. Others just need the employee’s spouse’s signature.

Court approval timing varies by jurisdiction. Most courts process QDROs within two to four weeks of submission.

The judge’s signature makes the QDRO legally enforceable. Without court approval, plan administrators cannot take any action on the order.

Step 4 — Plan Administrator Review and Implementation

After the court signs off, the plan administrator takes a close look at the QDRO to make sure it lines up with the retirement plan’s rules. This last check helps keep the plan out of legal trouble.

Federal law gives plan administrators 18 months to decide if a QDRO qualifies, but most wrap up their review in about 30 to 60 days.

During their review, administrators handle:

- Checking participant information

- Making sure calculations add up

- Ensuring the QDRO follows plan documents

- Reviewing legal formatting

If they approve the QDRO, the administrator separates out the alternate payee’s share. They set up new accounting for that portion.

Administrators sometimes reject QDROs due to technical errors or if the order doesn’t comply with the plan’s rules. Common reasons? Wrong benefit formulas or payment terms that just don’t work.

Once the QDRO is qualified, the alternate payee usually has a choice: take a distribution now or leave the funds in the plan. The plan’s rules and the alternate payee’s age decide what’s possible.

QDRO Process Timeline (Typical 60–120 Days)

The QDRO process usually takes a few months from start to finish. Gathering plan info early in the divorce can save a lot of headaches later.

Here’s how the timeline often breaks down:

| Phas | Duration | Key Activities |

| Drafting & Pre-approval | 2-4 weeks | Document gathering, QDRO preparation |

| Court Approval | 2-4 weeks | Judge review and signature |

| Plan Review | 4-8 weeks | Administrator qualification determination |

| Implementation | 1-2 weeks | Account setup and distribution processing |

Some retirement plans, especially government or military ones, can stretch the timeline to six months or more. They just have more hoops to jump through.

If there are multiple retirement accounts, each one needs its own QDRO. That can really drag things out.

When mistakes pop up or a QDRO gets kicked back, you may have to redo parts of the process. Getting things right the first time—and possibly seeking professional help—can prevent issues from dragging on indefinitely.

Common Mistakes to Avoid With QDROs

QDRO mistakes can cost divorcing couples thousands in lost retirement money.

Mix-ups like mislabeling assets, forgetting about survivor benefits, or just dragging your feet on paperwork can come back to bite you years down the road.

Mislabeling Assets or Beneficiaries

Getting the retirement account details wrong is one of the most expensive QDRO blunders. Administrators will toss out orders with incorrect account numbers, bad names, or the wrong plan listed.

Some common labeling mistakes:

- Listing an old employer name after a merger

- Mixing up account numbers between spouses

- Misspelling the alternate payee’s name

- Confusing plan types (like 401k vs 403b)

It’s smart to double-check everything with the plan administrator before you write up the QDRO. Even a one-digit typo in an account number can hold things up for months.

Beneficiary designations can be another headache. If the QDRO ignores existing beneficiaries, things get messy. The alternate payee should update their beneficiary info as soon as their share transfers.

Forgetting Survivor Benefits or Future Growth

QDROs need to mention survivor benefits. If the participant dies before retirement, and the order says nothing, the ex-spouse could lose everything.

Pension plans usually offer a few survivor benefit choices:

- Joint and survivor annuity – Payments keep coming to the surviving spouse

- Qualified pre-retirement survivor annuity – Coverage if the participant dies before retiring

- Pop-up provisions – Payments increase if the survivor dies first

People also forget to specify how to handle future investment growth. The QDRO should spell out whether the alternate payee gets gains and losses from the divorce date until the money moves.

Some couples freeze the dollar amount at the time of divorce—so the alternate payee misses out on market gains. Others split by percentage, which includes all growth until the transfer actually happens.

Delays in Filing the QDRO After Divorce

A lot of people find out about QDRO filing mistakes years after their divorce—usually when they try to get their money. Just having a divorce decree doesn’t move retirement funds. Only a properly filed QDRO does that.

Waiting too long can cause:

- Market losses for the alternate payee

- The participant taking out loans or withdrawals

- Plan changes that make things harder

- The participant dying before the transfer

Plan administrators usually need 30 to 60 days to review and approve a QDRO. If the plan is complicated or the paperwork is messy, it can take a lot longer.

The alternate payee should keep tabs on the filing process instead of just trusting their lawyer to handle it.

A lot of QDRO distribution problems come down to bad communication between attorneys and plan administrators.

Don’t let QDRO mistakes jeopardize your retirement. CollaborativeNow guides you step-by-step through account division. Contact us today to plan ahead with confidence.

If you’re ready to get started, call us now!

Tax Implications of QDROs

Knowing the tax side of a QDRO really matters if you want to avoid an ugly surprise at tax time.

The timing, paperwork, and how you handle distributions can all hit your financial bottom line in a big way.

Tax-Free Transfers vs. Taxable Withdrawals

If you set up the QDRO right, you can move retirement money without paying taxes immediately. The alternate payee can roll their share into an IRA or another qualified plan within 60 days.

But if they take the cash instead of rolling it over, it becomes taxable income. That amount gets tacked onto their income for that year.

Here’s the basic rundown:

| Transfer Type | Tax Status | Requirements |

| Direct rollover | Tax-free | Must complete within 60 days |

| Cash distribution | Taxable | Reported as ordinary income |

The usual 10% early withdrawal penalty doesn’t apply to QDRO distributions, even if the recipient is under 59½. That exception only works for the first distribution after the divorce, though.

Impact on Required Minimum Distributions (RMDs)

QDROs can change RMD requirements for both the original participant and the alternate payee. Once the alternate payee gets their share, they’re on the hook for their own RMDs at age 73.

The original participant figures their RMDs based on what’s left in their account after the QDRO. That usually means lower annual withdrawals.

For the alternate payee, RMD timing depends on what they do with their new funds:

- Rolling into an IRA? Standard RMD rules apply.

- Leaving money in the old employer plan? The plan might have different rules.

- Some plans make non-employees take the money out right away.

IRS Compliance and Documentation

The IRS wants QDROs to include certain details: names, addresses, and the exact amount or percentage to be transferred.

The plan administrator has to sign off on the QDRO before any money moves. They’ll check to make sure it fits both plan rules and federal law.

You’ll need this paperwork:

- The court-approved QDRO

- The plan administrator’s acceptance letter

- Tax ID numbers for both parties

- Distribution instructions

Keeping your documentation in order helps both sides avoid tax headaches later. Getting help from pros is never a bad idea when you’re dealing with retirement plan rules and tax law.

How Mediation Simplifies QDROs in Divorce

Mediation helps divide retirement accounts by creating a cooperative environment between divorcing spouses.

This process cuts down on conflict and makes QDRO preparation a lot smoother.

Key Benefits of Mediation:

- Lower costs – You skip expensive court battles.

- Faster resolution – Couples make decisions together, no waiting for court.

- Better communication – Both parties actually talk and work out solutions.

- More control – You get to decide your own terms.

The mediator walks both spouses through retirement account values and division options.

They break down how QDROs work in plain English, so nobody gets lost in legal jargon.

The QDRO process works after mediation because both parties already agreed on the terms.

This agreement goes into the divorce decree.

Mediation Steps for QDROs:

- Asset disclosure – Both spouses lay out all retirement account details.

- Valuation discussion – Figure out account values and how to split them.

- Agreement drafting – Write out the QDRO terms clearly.

- Plan review – Double-check requirements with plan administrators.

Couples who use mediation usually finish their QDROs faster than those who go to court.

The collaborative approach just means fewer headaches and less back-and-forth.

Mediation also gets couples thinking about tax consequences and timing issues.

The mediator might suggest when to transfer funds to get the best financial outcome.

This process takes some stress off and helps both parties feel heard during tough financial decisions.

Your retirement should be secure after divorce. CollaborativeNow provides mediation that makes QDROs clear and manageable. Schedule your confidential consultation with us now.

Contact Us Today For An Appointment

Frequently Asked Questions

What is the purpose of a QDRO in divorce?

A Qualified Domestic Relations Order (QDRO) allows retirement plan assets like 401(k)s or pensions to be divided during divorce without triggering taxes or penalties.

Do IRAs require a QDRO?

No. IRAs and Roth IRAs do not require a QDRO. Instead, they can be divided through a transfer incident to divorce, which avoids early withdrawal penalties.

How long does it take to process a QDRO?

The QDRO process typically takes 60–120 days, depending on court approval and plan administrator review. Delays often occur if paperwork is incomplete or unclear.

Who drafts the QDRO in a divorce?

QDROs are usually drafted by family law attorneys or QDRO specialists, then approved by the court and submitted to the retirement plan administrator for final acceptance.

Can I cash out my share from a QDRO?

Yes, but withdrawals are taxable unless rolled into another retirement account. Direct rollovers into an IRA allow spouses to avoid taxes and penalties.

What happens if a QDRO is never filed?

If a QDRO is not filed, the retirement plan administrator cannot divide assets. This can result in lost benefits or disputes years after the divorce is finalized.

Does a QDRO affect Social Security benefits?

No. QDROs apply to private retirement plans, not Social Security. Divorce-related Social Security benefits are governed by separate federal rules.