Tax & Alimony: What Fort Lauderdale Couples Need To Know After Settlement

Originally published: October 2025 | Reviewed by Carol Ann Mazza

Getting divorced in Fort Lauderdale brings about numerous changes, and taxes on alimony payments often catch people off guard.

Many folks still think the old rules apply, where the person paying alimony could deduct it and the recipient had to pay taxes on it.

That all changed for divorces finalized after January 1, 2019: alimony payments aren’t tax-deductible for payers, and recipients don’t need to report them as income.

This shift has made divorce settlements trickier and, honestly, more expensive for a lot of Fort Lauderdale couples who didn’t see it coming.

Understanding the tax implications of divorce settlements can save you thousands and save you a lot of headaches come tax time.

Florida’s specific rules, combined with federal changes, create a complex landscape that requires careful planning.

Key Takeaways

- Alimony payments in divorces finalized after 2019 aren’t tax-deductible for payers and aren’t taxable income for recipients.

- Many Fort Lauderdale couples stumble over current alimony tax rules and property transfer regulations.

- Getting professional tax and legal advice helps avoid expensive mistakes in divorce settlements.

How Do Alimony Payments Affect Taxes In 2025?

The year your divorce was finalized decides if alimony payments are tax-deductible for the payer or taxable income for the recipient. The 2019 law change wiped out most tax breaks for new divorce agreements.

Post-2019 Federal Rules Explained

Alimony payments now come from after-tax dollars for divorce agreements made after December 31, 2018. The payer can’t deduct these payments from their taxable income anymore.

The receiving spouse doesn’t have to report alimony as taxable income. That’s a total flip from how the IRS used to treat alimony.

Key requirements for post-2019 alimony:

- Payments must be under a divorce or separation agreement

- Spouses can’t file a joint tax return

- Payments stop when the recipient spouse dies

- Payments aren’t labeled as child support

This rule covers all new divorce and separation agreements. It also affects old agreements that are modified after 2018, if the change states that the new tax law applies.

Key Differences Between Old Vs. New Settlements

The date of your divorce settlement really matters for tax consequences in Fort Lauderdale. Pre-2019 the law let the paying spouse deduct alimony. That stopped after January 2019.

Pre-2019 Settlements:

- Payer deducts alimony payments

- Recipient reports as taxable income

- Usually saves the couple money on taxes

Post-2019 Settlements:

- No deduction for payer

- No taxable income for the recipient

- Payer shoulders the whole tax hit

This change really affects divorce negotiations. Higher earners now pay more tax when paying alimony, while recipients get support without tax worries.

Pre-2019 Vs. Post-2019 Tax Treatment Of Alimony

Alimony received in 2025 is only taxable if your divorce agreement happened before 2019 and hasn’t been modified to change that. The IRS says these rules are here to stay.

Pre-2019 Tax Treatment:

- Payers claim alimony as an above-the-line deduction

- Recipients include payments in gross income

- Tax burden shifts to the lower-earning spouse

- Creates tax savings for some divorcing couples

Post-2019 Tax Treatment:

- No tax benefits for the payer

- Recipients get tax-free income

- Higher-earning spouse pays taxes on their full income

- No more tax loopholes for alimony

Couples with pre-2019 agreements should avoid changes that trigger the new tax rules. The IRS applies current law if you modify your agreement and reference post-2018 tax treatment.

Existing agreements adhere to the old rules unless you intentionally modify them. That’s something to think about if you’re considering revisiting your agreement.

Florida-Specific Rules On Alimony And Taxes

Florida courts set alimony terms, but state law aligns with federal tax treatment, meaning most Fort Lauderdale couples face uniform rules post-settlement.

Types Of Alimony In Florida

Florida law categorizes alimony into different types, each with its own specific time limits and underlying reasons for existence.

Bridge-the-gap alimony helps someone get from married life to single life. Judges cap this at two years. It’s for things like a new apartment deposit or job training.

Rehabilitative alimony is for education or job training. The recipient must demonstrate a plan for becoming self-supporting. Courts usually award this for finishing school or getting a certificate.

Durational alimony lasts for a set period, but never exceeds the duration of the marriage itself. Judges use this when permanent alimony isn’t right but ongoing support is still needed.

If your divorce was finalized after January 1, 2019, recipients don’t pay taxes on any alimony, and payers don’t get to deduct it.

How Judges Consider Tax Implications During Divorce Proceedings

Florida judges must consider taxes when determining alimony amounts and payment methods. These tax details directly shape the financial outcome for both people.

Courts look at each person’s tax bracket and filing status. If the higher earner pays alimony, their tax situation differs from that of the recipient. Federal law decides if alimony is taxable in Florida based on your divorce date.

Judges are limited to a formula that compares the parties’ net income when determining alimony needs. Alimony in Florida is 35% of the differences in the parties’ net monthly incomes or the reasonable need of the spouse seeking alimony, whichever is less.

In an out of court process, such as Collaborative Divorce, part of a couple’s agreement might include payment amounts to balance out tax obligations. That way, the recipient actually gets enough support after taxes.

The court also determines whether lump sums or monthly payments are more tax-efficient. Sometimes, property transfers work out better than ongoing alimony.

Judges also consider dependency exemptions and child tax credits. These can really affect each parent’s tax bill. Courts may split these benefits as part of the financial settlement.

If you’re ready to get started, call us now!

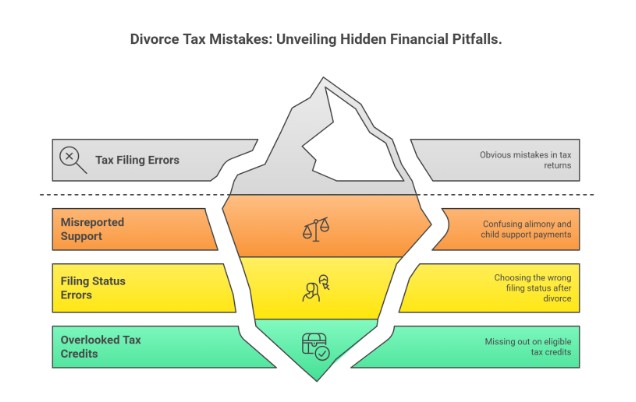

Common Tax Mistakes Fort Lauderdale Couples Make After Divorce

Divorced couples often make mistakes with their taxes, particularly with support payments and selecting the correct filing status. These mistakes can result in audits, penalties, and lost tax benefits.

Misreporting Support As Alimony Or Child Support

The IRS draws a hard line between alimony and child support. Plenty of divorced couples make mistakes by mixing up the two on their tax returns.

Alimony Requirements:

- Cash payments only

- Must be required by a divorce decree or separation agreement

- Ends when the recipient dies

- Can’t be labeled as child support

Child Support Rules:

- Payer can’t deduct it

- Recipient doesn’t pay tax on it

- Usually set by court guidelines

Some couples attempt to claim child support as alimony to obtain a deduction, but the IRS scrutinizes these claims. The recipient would have to report that as income, which causes problems.

Others attempt to refer to child support as “alimony” in their agreements. The IRS looks for clues, such as payments that decrease when a child reaches a certain age.

Common Error: Writing “spousal support” in the agreement when the money’s really for stuff like school fees or medical bills for the kids.

Incorrect Filing Status (Single Vs Head Of Household)

Choosing the wrong filing status can cost divorced folks thousands in extra taxes. Tax issues during divorce often involve confusion about when to update one’s status.

Head of Household Benefits:

- Bigger standard deduction than single filers

- Lower tax rates

- Better earned income tax credit

Qualification Requirements:

- Unmarried on December 31st

- Pay more than half the household bills

- Have a qualifying dependent living with you over half the year

A lot of divorced parents file as single when they actually qualify for head of household. Usually, they just don’t realize they meet the rules.

Example: Say a mom pays $18,000 a year for rent, utilities, and food. Her ex kicks in $6,000 in child support. She qualifies as the head of household because she covers more than half of the costs.

Some people claim head of household when the kids split time 50/50. The IRS states that the child must live with you for more than 183 days a year to qualify.

Overlooking Tax Credit Eligibility (Dependents, Child Tax Credit, EITC)

Divorced parents often overlook valuable tax credits or claim them the wrong way. Costly mistakes divorced couples make usually involve confusion about who can claim children as dependents or not deciding the issue at the time of the agreement.

Child Tax Credit Rules:

- Worth up to $2,000 per child under 17

- Only one parent can claim per child per year

- Typically goes to the parent with primary custody

Dependent Exemption Guidelines:

- Child must live with the parent more than half the year

- Parent needs to provide more than half of the child’s support

- Can transfer the exemption to the non-custodial parent with Form 8332

The Earned Income Tax Credit (EITC) can mean big refunds for lower-income parents. After a divorce, many parents don’t realize they might qualify if their income drops.

Common Mistake: Both parents claim the same child as a dependent. The IRS catches this fast and delays refunds for both sides.

Some couples attempt to split their children’s tax benefits for financial gain without adhering to IRS rules. You can’t just decide who claims which child—there are specific tests you have to meet.

Strategies To Minimize Tax Burden Post-Divorce

Careful planning—such as timing payments, clarifying settlement language, and updating withholdings—helps reduce unexpected tax bills.

Negotiating Tax-Smart Settlements With Professional Help

Professional guidance during divorce negotiations helps couples dodge expensive tax errors. Attorneys specializing in tax law can craft agreements that work for both parties.

Key negotiation strategies include:

- Timing asset transfers to skip capital gains taxes

- Splitting retirement accounts as tax-free transfers

- Planning property sales for good tax years

- Creating payment schedules that boost tax benefits

It pays to talk about who claims the kids as dependents. This choice can result in thousands of dollars in tax credits and deductions every year.

Lump-sum alimony payments can wipe out ongoing tax headaches. The paying spouse is relieved of future payments, and the recipient receives cash upfront.

Dividing property takes real thought. If you move low-basis assets to the spouse in a lower tax bracket, the family as a whole might pay less tax.

Role Of CPAs And Divorce Financial Planners

Certified Public Accountants step in with crucial tax advice during divorce. They figure out the real after-tax value of different settlement options.

CPAs help with:

- Projecting future tax bills

- Analyzing retirement account splits

- Timing asset sales

- Building post-divorce tax strategies

Divorce financial planners focus on the long game. They show how different settlements could shape both spouses’ financial futures.

These pros team up with attorneys to create tax-efficient settlement structures. Their advice usually saves more money than it costs.

Financial planners also walk clients through new filing statuses. Switching to single or head of household status can significantly impact your deduction limits and tax bracket.

Benefits Of Mediation In Tax-Heavy Divorces

Mediation provides couples with the opportunity to explore creative tax solutions together. Unlike court, mediation allows both sides to explore options with their advisors.

Mediation advantages include:

- Flexible settlement timing

- Chance to model different scenarios

- Less adversarial pressure

- Cost savings that can offset professional fees

Complex tax cases really benefit from mediation. Business owners, high earners, or anyone with lots of properties needs time to get it right.

Mediators who understand finances are aware of the tax implications. They steer talks toward solutions that cut the family’s total tax bill, not just help one spouse win.

Another out of court process, the Collaborative Process, often leads to better tax results than the court. Judges may not have the authoriy to examine every tax angle when dividing property.

Understanding alimony and tax rules matters long after divorce. CollaborativeNow offers mediation and other out of court process services designed to promote clarity and peace of mind. Contact us to discuss your options today.

If you’re ready to get started, call us now!

Impact Of Alimony On Retirement Accounts & Investments

Alimony settlements influence how couples divide retirement assets and plan their investments. The process requires specific legal tools and introduces new tax considerations for both parties.

Using QDROs (Qualified Domestic Relations Orders)

A QDRO allows couples to split retirement accounts without incurring early withdrawal penalties. The court order tells plan administrators to move funds from one spouse’s 401(k) or pension to the other.

Retirement accounts are considered part of the marital estate and can impact alimony. The spouse getting the money can take it now or roll it into their own retirement plan.

Key QDRO benefits:

- No 10% early withdrawal penalty

- Tax-deferred transfers between accounts

- Immediate access to funds if needed

The QDRO must spell out the exact dollar amount or percentage. It can’t ask the plan to offer benefits it doesn’t already provide. Every plan has its own QDRO requirements, so it’s essential to review the details.

Adjusting IRA & 401(k) Contributions Post-Settlement

Alimony payments can alter retirement contribution rules depending on when the divorce occurred.

Whether alimony counts as earned income for IRA contributions depends on the date of the agreement.

If you divorced before 2019, alimony payments count as earned income for IRA contributions. For divorces after 2019, that benefit was no longer available.

Contribution limits for 2025:

- Traditional/Roth IRA: $7,000 ($8,000 if over 50)

- 401(k): $23,500 ($31,000 if over 50)

Paying spouses may need to reduce their retirement contributions to cover alimony. Recipients should strive to maximize contributions while the payments last to enhance long-term security.

Capital Gains And Property Division Considerations

Spouses can usually transfer property tax-free during the divorce process. However, the spouse who receives the asset also retains its original cost basis, which is relevant for future capital gains taxes.

Dividing investment accounts brings different tax headaches than splitting retirement accounts. If you get taxable investment accounts, you might owe capital gains if you sell assets right away.

Tax considerations:

- Primary residence: Up to $250,000 capital gains exclusion per person

- Investment property: Capital gains tax due when you sell

- Stock portfolios: Basis transfers along with the asset

Couples should consider which spouse will take which assets based on their individual tax situations.

Sometimes, the higher earner actually comes out ahead by taking assets with built-in gains. But honestly, it depends—there’s no one-size-fits-all answer here.

Professional Guidance: Why Couples Shouldn’t Go It Alone

Divorcing couples in Fort Lauderdale often encounter complex tax rules when addressing alimony. Professional advice can help avoid costly mistakes and tax penalties.

Tax Law Changes Create Confusion

The 2017 tax overhaul flipped the rules on alimony upside down. Many couples are unsure which rules actually apply to them.

A tax professional can walk you through the differences between old and new regulations. It’s not always as clear as you’d hope.

State vs. Federal Rules

Some states treat alimony differently from federal rules. If you’re in Florida, you’ve got to juggle both state and federal requirements.

This double-layered system? It’s a recipe for confusion and mistakes.

Key Areas Where Experts Help:

- Timing issues – The date you sign your divorce agreement changes the tax treatment.

- Documentation – Keeping the right paperwork on file now saves a headache with the IRS later.

- Planning strategies – You can structure payments in a way that shrinks your tax bill.

- Compliance – Stay on the right side of the rules and avoid penalties or rejected deductions.

Long-Term Financial Impact

Current tax laws can have serious long-term financial consequences. Something that seems straightforward today might backfire years from now.

Multiple Professionals May Be Needed

Couples typically achieve the best results by collaborating with both tax advisors and divorce attorneys. Each one brings their own angle to the table.

When they collaborate, they can create agreements that truly benefit both parties. It’s just smarter that way.

Secure a smoother post-divorce transition by working with CollaborativeNow on your alimony and settlement concerns. Plan with confidence—schedule your confidential consultation with us now.

Contact Us Today For An Appointment

Frequently Asked Questions

Is alimony taxable in Fort Lauderdale after divorce?

No. Under the Tax Cuts and Jobs Act (TCJA), alimony payments for divorce settlements finalized after January 1, 2019, are not tax-deductible for the payer and are not taxable income for the recipient.

Can alimony be deducted on federal or Florida state taxes?

Alimony is no longer deductible on federal tax returns for divorces finalized after 2019. Florida has no state income tax, so there is no deduction or reporting required at the state level.

How do child support and alimony differ for tax purposes?

Alimony and child support are treated differently. Alimony is not taxable or deductible under current federal law, while child support has never been tax-deductible for the payer or taxable for the recipient.

Do I need to report alimony on my tax return?

If your divorce was finalized after 2019, you do not need to report alimony as income, nor can you deduct it as an expense. For older agreements, alimony may still be taxable/deductible depending on the terms. Always confirm your settlement date before filing your tax return.

Can mediation help reduce tax issues with alimony?

Yes. Mediation allows couples to structure settlements with tax implications in mind, ensuring clarity in how payments are classified. This proactive approach can minimize disputes with the IRS and help both parties create fair, financially efficient agreements, avoiding the higher costs associated with litigation.

How does alimony affect retirement accounts or investments?

Alimony payments can reduce disposable income, potentially affecting retirement contributions and investment strategies. Couples dividing retirement accounts through a Qualified Domestic Relations Order (QDRO) should consider the potential future tax implications.

What are common tax mistakes after divorce in Fort Lauderdale?

Frequent errors include misreporting alimony, selecting the incorrect filing status, failing to update withholdings, and overlooking credits such as the Head of Household or Child Tax Credit.